A Secret Weapon For 3 Things To Avoid When Filing Bankruptcy

Eligibility, protection, limits and exclusions of identity theft insurance plan are ruled by a separate protection document.

Repayment Designs: Creating a structured repayment prepare with all your creditors is usually an effective technique to steadily pay off your debts. These strategies typically define the amount you pays each month and for just how long, providing a transparent roadmap to starting to be credit card debt-totally free.

You could possibly acquire the bankruptcy discharge form letter after you have officially been discharged. The shape states that creditors simply cannot go after discharged debts, that a lot of debts are discharged, and that some debts are usually not discharged. In this article’s how the form appears to be like:

If at any time the financial debt settlement corporation doesn’t adhere to its contract, you need to arrive at out in your legal professional.

With any luck ,, the pre-bankruptcy counseling and debtor instruction programs served and now you're on stable economic footing. In the event you’re however scuffling with debt, you are able to get in touch with considered one of our authorities without spending a dime to study possible financial debt aid remedies.

Examine the organization’s disclosures. A legit financial debt settlement business ought to Present you with disclosures. It is best to study them cautiously. In case you don’t acquire everything, then don’t sign with the company.

Filing bankruptcy in Ohio generally is a challenging conclusion for A lot of people. With any luck ,, the articles in this article will let you know look here how to file bankruptcy, comprehend The prices and positives visit site and negatives, and alternate options.

3. Do I have credit card debt that bankruptcy won’t eliminate? Bankruptcy doesn’t wipe out all sorts of financial debt. Some illustrations that may’t be removed by filing for bankruptcy include:

A debt administration program doesn’t lessen the total you owe, even though the credit history counselor might be capable of get charges waived or your curiosity rate lessened.

Do you live inside a town in Michigan and want unique info on filing bankruptcy as part of your metropolis? Does one want to know how to find a reliable lawyer in or in the vicinity of your town?

This information is considered 22,787 moments. Whilst bankruptcy offers a number of people a clear over here slate, it really is on no account a straightforward Resolution. Bankruptcy will destroy your credit and will perhaps drive you to promote your belongings. It could also affect your long term employment. In addition, the 2005 bankruptcy reform guidelines designed it harder to file for chapter seven bankruptcy and minimal other bankruptcy rights.

When looking at small business bankruptcy, it’s necessary to comprehend the different sorts readily available to ascertain the most see post beneficial course of motion. Bankruptcy security provides a legal course of action that helps companies restructure their debts or liquidate belongings to repay creditors.

Obtain authentic credit card debt settlement providers. Most personal debt settlement firms are “for gain,” and in almost any gain-seeking subject there are plenty of cons. Ensure that you study any debt settlement firm the thing is on the web or advertising on tv.

Reduce your student bank loan payments. There are many choices for people today drowning in scholar personal loan credit card debt. For example, you could quickly this content minimize or defer payments on university student financial loans.

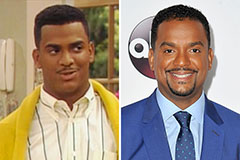

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now!